By Sundance, CONSERVATIVE TREEHOUSE 25 March 2024

If you followed my research on banking and the reality of the Russian sanction regime, this report from Reuters today takes on an entirely new dimension.

ME: …”The same way the Patriot Act was not designed to stop terrorism but rather to create a domestic surveillance system. So too were the “Russian Sanctions” not designed to sanction Russia, but rather to create the financial control system that will lead to a USA digital currency. The Western sanctions created a financial wall around the USA (dollar-based west), not to keep Russia out, but to keep us in. The Western sanction regime, the financial mechanisms they created and authorized, created the control gate that leads to a U.S. digital currency.” (more)

REUTERS TODAY: …”The firm [SWIFT] has gone from being virtually unknown outside banking circles to a household name since 2022 when it cut most of Russia’s banks off from its network as part of the West’s sanctions for the invasion of Ukraine. (more)

[The map shows the global financial cleaving, an outcome of sanctions against Russia]

[The map shows the global financial cleaving, an outcome of sanctions against Russia]

I first started to deep dive research into these CBDC datapoints when the Russian sanctions were triggered.

You see, nothing about the sanctions really made sense from the way they were structured. Never before, not with Iran, North Korea, Venezuela or Cuba was the dollar weaponized against any entity who did not conform to the sanctions. Additionally, the intensity of the drive to make the sanctions the tip of the Western spear was just too pointed; something about it didn’t make sense. That’s what took me to dig deep into the sanction impact and realize nothing said about these financial sanctions made sense when compared against their actual outcome. {Go Deep}.

So, let’s start with the latest development:

(Reuters) – Global bank messaging network SWIFT is planning a new platform in the next one to two years to connect the wave of central bank digital currencies now in development to the existing finance system, it has told Reuters.

The move, which would be one of the most significant yet for the nascent CBDC ecosystem given SWIFT’s key role in global banking, is likely to be fine-tuned to when the first major ones are launched.

Around 90% of the world’s central banks are now exploring digital versions of their currencies. Most don’t want to be left behind by bitcoin and other cryptocurrencies, but are grappling with technological complexities.

SWIFT’s head of innovation, Nick Kerigan, said its latest trial, which took 6 months and involved a 38-member group of central banks, commercial banks and settlement platforms, had been one of the largest global collaborations on CBDCs and “tokenised” assets to date.

“We are looking at a roadmap to productize (launch as a product) in the next 12-24 months,” Kerigan said in an interview. “It’s moving out of experimental stage towards something that is becoming a reality.”

Although the timeframe could still shift if major economy CBDC launches get delayed, getting out the blocks for when they do would be a major boost for maintaining SWIFT’s incumbent dominance in the bank-to-bank plumbing network.

[…] A raft of heavyweight commercial banks including HSBC, Citibank, Deutsche Bank, Societe Generale, Standard Chartered and the CLS FX settlement platform all took part too, as did at least two banks from China.

The idea is that once the interlink solution is scaled-up, banks would have one main global connection point able to handle digital asset payments, rather than thousands if they were to set up an individual one with every counterparty. (read more)

The sanction regime against Russia was always intended to generate this outcome. This is the feature of the sanctions, not a flaw.

This dollar based CBDC was the intended destination of the people who constructed the Russian sanction plan (ex. BlackRock/WEF types). The Western politicians then were recruited and given instructions to support. Their cover story was “Build Back Better,” ie climate change, which was the predicate to the Russian sanctions.

I know at first blush a lot of this CBDC discussion seems esoteric, difficult to understand, and there are a lot of other issues happening simultaneously in the background. However, if you contemplate the biggest threat on this overarching power arc of Western government, you arrive to understand how serious this seemingly opaque issue really is.

2022 – NEW YORK, March 24 (Reuters) – BlackRock Inc’s (BLK.N) chief executive, Larry Fink, said on Thursday that the Russia-Ukraine war could end up accelerating digital currencies as a tool to settle international transactions, as the conflict upends the globalization drive of the last three decades.

In a letter to the shareholders of the world’s largest asset manager, Fink said the war will push countries to reassess currency dependencies, and that BlackRock was studying digital currencies and stablecoins due to increased client interest.

“A global digital payment system, thoughtfully designed, can enhance the settlement of international transactions while reducing the risk of money laundering and corruption”, he said.

[…] In the letter on Thursday, the chairman and CEO of the $10 trillion asset manager said the Russia-Ukraine crisis had put an end to the globalization forces at work over the past 30 years.

[…] “While companies’ and consumers’ balance sheets are strong today, giving them more of a cushion to weather these difficulties, a large-scale reorientation of supply chains will inherently be inflationary,” said Fink.

He said central banks were dealing with a dilemma they had not faced in decades, having to choose between living with high inflation or slowing economic activity to contain price pressures. (read more)

When the White House first started openly saying the Biden administration was reviewing how to implement CBDC’s, yes THAT Announcement ACTUALLY HAPPENED, September 2022, things from a research perspective really started to get serious. “While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC.” Whenever the U.S. govt says they’re “undecided,” pay close attention.

First things first with the Western financial sanctions- specifically the SWIFT exchange. It is true you cannot use VISA, Mastercard or any mainstream Western financial tools to conduct business in Russia; however, the number of workarounds for this issue are numerous. One of those tools is the use of a cryptocurrency like Bitcoin; and within that reality, you find something very ominous about the USA motive against crypto.

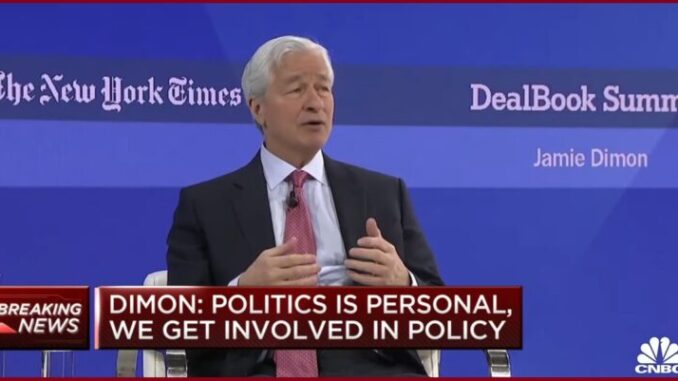

(Newsmax) – JPMorgan Chase CEO Jamie Dimon on Wednesday suggested bitcoin currency should be banned. Dimon was speaking during a Senate Banking, Housing and Urban Affairs Committee hearing on Capitol Hill.

“I’ve always been deeply opposed to crypto, bitcoin, etc.,” Dimon said in response to a question from Sen. Elizabeth Warren, D-Mass. “The only true use case for it is criminals, drug traffickers … money laundering, tax avoidance because it is somewhat anonymous, not fully, and because you can move money instantaneously. “If I was the government, I would close it down.” (read more)

Dimon was/is positioning JPMorgan to be one of the facilitating beneficiaries of the financial control system evident within any CBDC process.

The US Treasury has set the financial system on an almost irreversible path to a U.S. Central Bank Digital Currency. As direct consequence, crypto currency alternatives are a threat to the establishment of that Western objective. This reality also pulls in the explanation around why the USA is so all-in for the banker-driven World War Reddit – the Russia-Ukraine conflict.

Conflict with Russia created the opportunity for the USA to create a sanctions regime that doesn’t truly sanction Russia; instead it controls the world of USA dollar-based finance. At the end of that control mechanism is a digital dollar, a Central Bank Digital Currency…. and by extension full control over U.S. citizen activity. The Marxist holy grail.

Take those reference points as an overlay, and now consider this little discussed 2022 announcement from the Biden administration:

[White House] – President Biden often summarizes his vision for America in one word: Possibilities. A “digital dollar” may seem far-fetched, but modern technology could make it a real possibility.

A United States central bank digital currency (CBDC) would be a digital form of the U.S. dollar. While the U.S. has not yet decided whether it will pursue a CBDC, the U.S. has been closely examining the implications of, and options for, issuing a CBDC. If the U.S. pursued a CBDC, there could be many possible benefits, such as facilitating efficient and low-cost transactions, fostering greater access to the financial system, boosting economic growth, and supporting the continued centrality of the U.S. within the international financial system. However, a U.S. CBDC could also introduce a variety of risks, as it might affect everything ranging from the stability of the financial system to the protection of sensitive data.

Notably, these benefits and risks might vary significantly based on how the CBDC system is designed and deployed. That is why Executive Order 14067, Ensuring Responsible Development of Digital Assets, placed the highest urgency on research and development efforts into the potential design and deployment options of a U.S. CBDC. The Executive Order directed the Office of Science and Technology Policy (OSTP), in consultation with other Federal departments and agencies, to submit to the President a technical evaluation for a potential U.S. CBDC system.

Today, OSTP is publishing its report, Technical Evaluation for a U.S. Central Bank Digital Currency System, which lays out policy objectives for a potential U.S. CBDC system and analyzes key technical design choices for a U.S. CBDC system. The report also estimates the technical feasibility of building a CBDC minimum viable product and describes how a U.S. CBDC system might affect Federal operations. The report makes recommendations on how to prepare the Federal Government for a U.S. CBDC system. Importantly, the report does not make any assessments or recommendations about whether the U.S. should pursue a CBDC, nor does it make any decisions regarding particular design choices for a potential U.S. CBDC system. (read more)

When you read that full announcement, you realize they have already built the system.

If the system is built, and they are now making policy recommendations for implementation, the question becomes, ‘What’s the goal’?

Leave a Reply

You must be logged in to post a comment.